Behavioral Analysis (BA) is an essential tool for financial institutions looking to conduct historical analysis of their products to apply the right assumptions for Balance Sheet modeling. By analyzing the behavioral characteristics of both term and non-term products, the BA module assists banks in identifying core and volatile deposits, overdrafts, and loans. BA also provides analysis of term deposits pre-mature and rollover patterns, as well as prepayment analysis for loans. Additionally, the BA module facilitates analysis of LC Devolvement and BG invocation, ensuring banks have a comprehensive view of their financial position. With BA, banks can make informed decisions by applying the right assumptions for financial modeling based on historical behavioral analysis of their products.

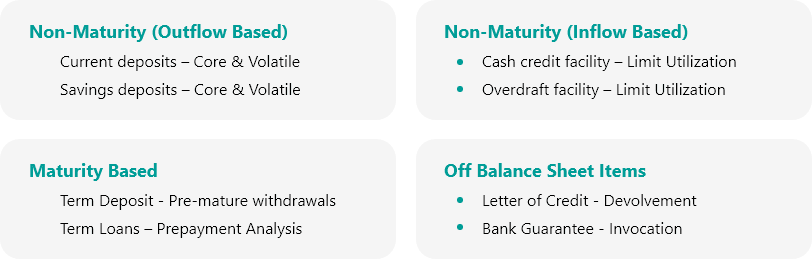

Our BA application broadly supports the following categories of models: